Pivio platform

The debt capital markets need the peace of mind of traditional fixed income to build institutional confidence in digital assets

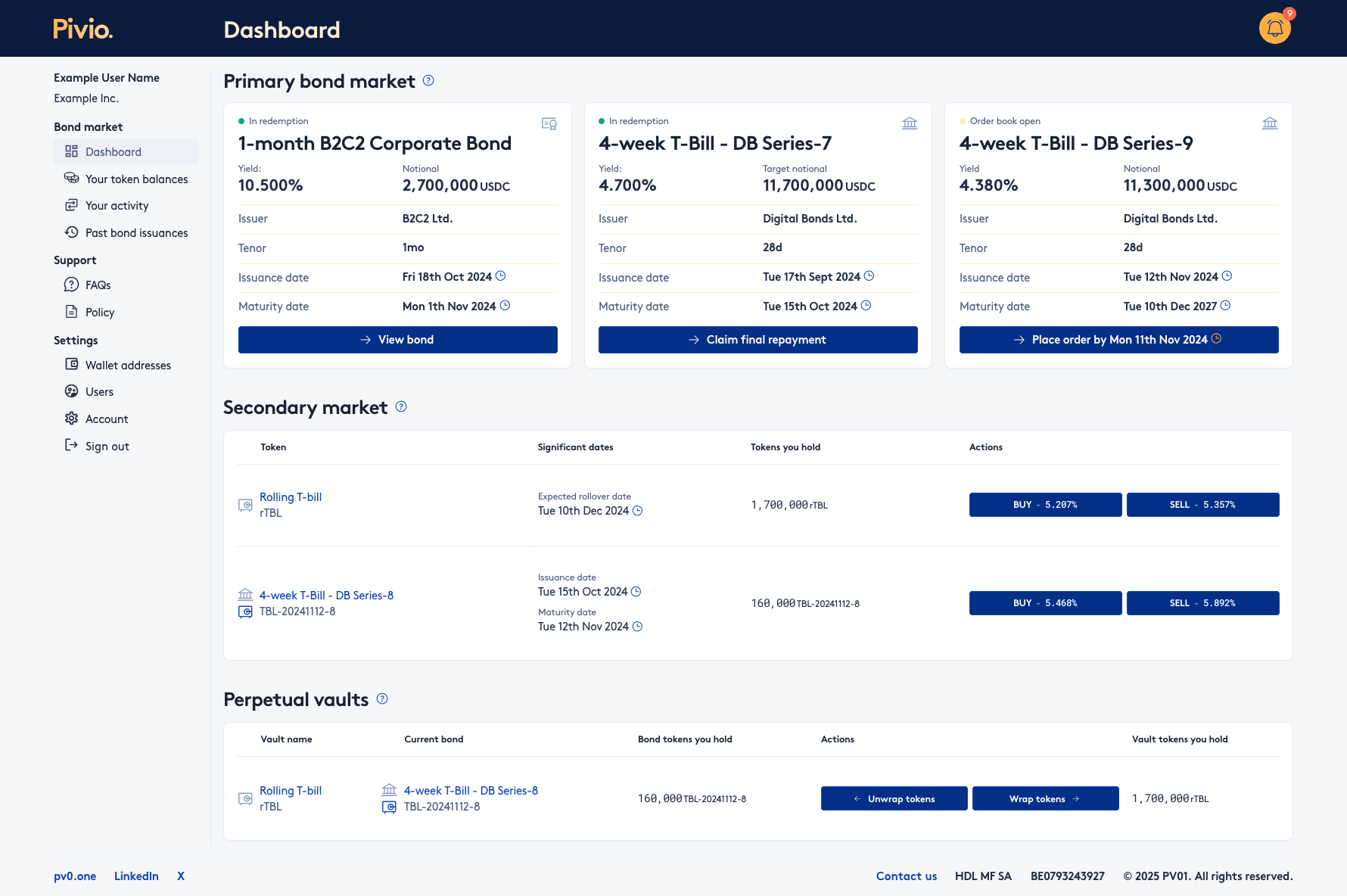

Investors can access our platform to invest in Digital Treasury Bills, issued as ERC-20 tokens that are collateralised one-for-one by the corresponding US Treasury bonds

The entire lifecycle of these digitally native assets takes place on-chain across issuance, transfers, trading, and redemption, without the need for a clearing system or central securities depository.

It’s about time: the fixed income market is due for an upgrade.

Launch Pivio- Interest-bearing collateral using stablecoins

- Transparency into counterparty debt

- Real-time settlement

- Vetted issuances

- Full access & control over bonds through duration

- Seamless due diligence and underwriting process

How it works

The full issuance process explained

PV01 acts as the arranger and broker-dealer for issuers of digital bonds, and manages the structuring, book-building, and sales process to qualified non-US institutional investors through its non-custodial platform, Pivio.

Launch Pivio-

1Subscription period Place your order, without transferring funds

-

2Issuance period Settle your order in USDC, receive Digital Bond Tokens

-

3Outstanding period Trade & transfer Digital Bond Tokens

-

4Maturity date Claim your final repayment in USDC